Why Portfolio Companies Must Embrace the Gen AI Revolution — Now!

New Bain Global Private Equity Report Sees Gen AI is a Game-Technology for Portfolio Companies in Value Creation

Capturing the immense power of Generative AI to drive value creation is on the agenda of most private equity-backed CEOs. As the transformative force of our time, Gen AI is not just redefining the nature of work; it’s reshaping entire industries and disrupting business as we know it. Sooner or later, this revolutionary technology will impact every industry, every company, and the job of every knowledge worker.

The urgency to lean into Gen AI is resoundingly affirmed in the recently released Bain Global Private Equity Report 2024. In the chapter Harnessing Generative AI in Private Equity, Bain observes that Gen AI is asserting itself as a game-changing technology across the global economic landscape. They envision it being rapidly deployed in portfolio companies to drive:

Operational efficiency. AI tools enable portfolio companies to streamline operations, automate routine tasks, and optimize labor use, leading to significant cost savings and operational efficiency gains that directly impact the bottom line.

Talent acquisition and optimization. Gen AI can augment the capabilities of existing staff, empowering humans to focus on higher-value activities while AI handles more routine tasks, thereby optimizing talent utilization and unlocking hidden potential.

Market competitiveness. Early adopters of Gen AI can seize a powerful competitive edge in the market by enabling innovations that outpace rivals and disrupt traditional business models, positioning themselves as industry leaders.

Improved decision making. Gen AI turbocharges decision-making by providing comprehensive data analysis that uncovers insights not immediately apparent through conventional methods, enabling leaders to make smarter, more informed choices.

Customer Interaction. AI can revolutionize customer service and engagement through more personalized and responsive communication tools, driving customer satisfaction and retention rates to new heights.

Value Creation. Implementing AI-driven solutions can directly contribute to value creation by enhancing product offerings, improving service delivery, and creating entirely new revenue streams that propel growth.

The CEOs of PE-backed portfolio companies that I coach and consult are leaning into Gen AI with fervor. While the potential benefits touted in the Bain report are undeniably attractive, they don’t materialize automatically (a point Bain glossed over). To make those transformative strides requires significant training, practice, and widespread adoption of Gen AI across your entire organization.

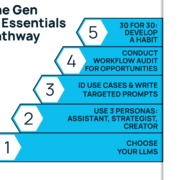

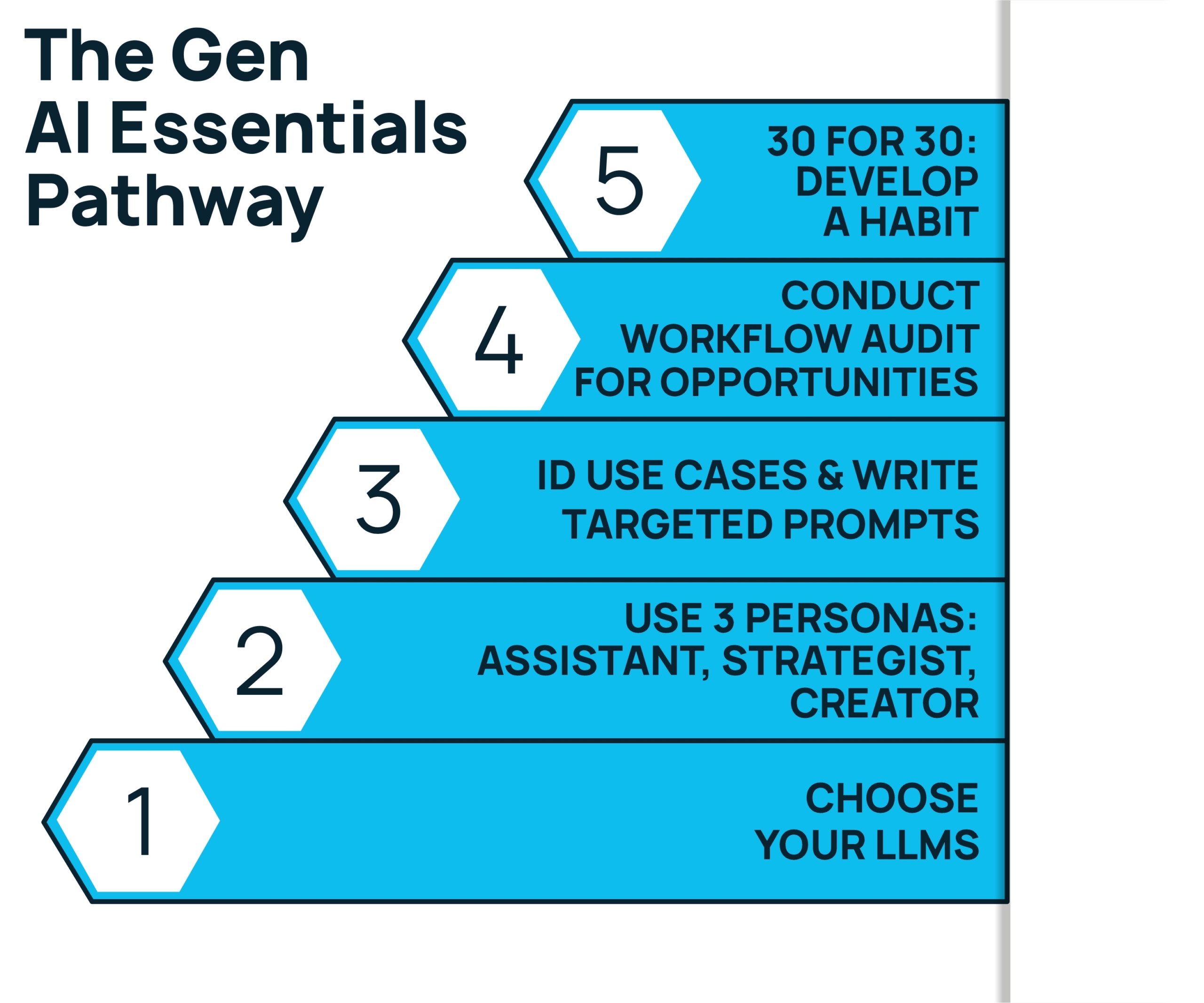

When I train leaders on Gen AI, I introduce them to the Gen AI Essentials Pathway, a powerful learning protocol that emphasizes the foundational elements necessary to build Gen AI literacy, proficiency, and adoption skills. It encompasses five steps:

In the training, all knowledge workers (including the CEO and C-suite) discover how to select and use large language models (LLMs) and how to craft prompts that elicit excellent outputs. They learn the three powerful personas they can leverage to harness the full potential of Gen AI: as an assistant, a strategist, and a creative force. They practice writing targeted prompts that deliver exceptional results. They are introduced to fifteen high-impact use cases and corresponding prompts that are invaluable for leaders and managers. Then, they conduct workflow audits of their critical objectives and tasks to identify use cases where Gen AI can be applied to maximize brainpower and human potential.

Before embarking on any task, they start by asking, “Can Gen AI help me with this?” As the training concludes, they are invited to participate in the 30-Day Challenge. I share examples of individuals who have dedicated just 30 minutes a day to Gen AI for 30 days, developing a new, indispensable habit that results in significant productivity gains, time savings, and better decision-making. A goal of a 20% productivity increase is established as a starting point.

We reconvene a month later to share our learnings and breakthroughs. Many participants report productivity improvements that exceed the initial 20% target. We dive into the use cases they are applying, the AI tools they’ve experimented with, the remarkable results they are achieving, and the exciting next steps on their Gen AI journey. Suggestions and best practices are freely shared, all in a spirit of discovery, learning, and leaning into this extraordinary new superpower. We discuss pain points and opportunities across the company where Gen AI can make a transformative impact, and then prioritize high-potential projects. They receive additional training, collaborating to apply Gen AI in innovative ways. Then we rinse and repeat, building their Gen AI capability that puts them on the path to delivering the game-changing benefits described by Bain.

If you want to get your people excited about Gen AI, you have to answer their first question: “What’s in it for me? “ When they see how Gen AI can help in their personal workflows to save time, help them make better decisions and do higher quality work, then they’ll be ready to tackle the company’s opportunities and challenges. Start by showing them how Gen AI can make their lives better.

A soldier isn’t forged without the crucible of bootcamp. A major league baseball player doesn’t reach the pinnacle of their sport without the rigors of spring training. Similarly, your team members won’t become Gen AI powerhouses without proper training and support. If you truly want to reap the rewards that Gen AI promises, invest in providing everyone with a solid foundation through comprehensive training and a robust learning process. Fail to do so, and you risk being left in the dust by competitors who are seizing this once-in-a-generation opportunity.

The Gen AI revolution is here, and the time to act is now. Portfolio companies that embrace this transformative technology and invest in building their Gen AI capabilities will be the ones that thrive in the new era of business. Don’t let this moment pass you by. Lean into the power of Gen AI, train your team to harness its full potential, and watch as your company soars to new heights of efficiency, competitiveness, and value creation. The future belongs to those who dare to embrace it — will you be among them?